The business setup in UAE presents a lucrative opportunity for entrepreneurs worldwide, thanks to its strategic location, pro-business environment, and robust economy. However, navigating the government approval process can seem daunting. This article serves as a practical guide, drawing from experience and offering insights into securing the necessary approvals for your business setup in UAE. Forget convoluted jargon and confusing instructions. This is about providing you with a clear path forward, based on real-world experiences of setting up businesses in the Emirates.

Understanding the Legal Structures Available for Your Business Setup

Before even thinking about approvals, you need to decide on the legal structure for your business. This choice significantly impacts the required documentation and the approval process. Options range from sole proprietorships and limited liability companies (LLCs) to free zone establishments and branches of foreign companies.

A sole proprietorship, typically suitable for smaller operations and individual entrepreneurs, requires a simpler registration process compared to an LLC. However, it also means the owner bears unlimited liability for the business’s debts. An LLC, on the other hand, offers limited liability, protecting the owner’s personal assets. This is a popular option, but it involves more stringent requirements and potentially higher setup costs.

Free zone entities offer 100% foreign ownership and tax benefits, making them attractive for export-oriented businesses. Branches of foreign companies are often chosen by established international businesses looking to expand their presence in the UAE. Each structure has its own set of rules and regulations, so thoroughly research your options. Your choice should align with your business activities, long-term goals, and risk appetite. Speaking to a legal consultant is highly recommended at this stage.

Gathering the Essential Documentation for Your Application

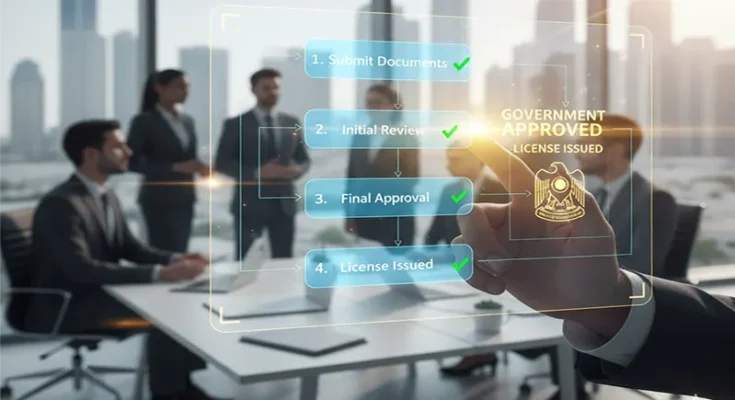

Once you’ve chosen your legal structure, you need to gather the necessary documents. This is a crucial step, as incomplete or incorrect documentation can lead to significant delays. The exact requirements vary depending on your chosen legal structure and the emirate you’re operating in, but generally include:

- Passport copies and visa details of the business owner(s) or shareholders.

- Trade name reservation certificate.

- Memorandum of Association (MOA) and Articles of Association (AOA) – these define the company’s purpose, ownership structure, and internal regulations.

- Office space lease agreement or Ejari (the official registration of tenancy contracts in Dubai).

- No Objection Certificate (NOC) from the sponsor (if applicable).

- Detailed business plan outlining your activities, target market, and financial projections.

- Bank statements and other financial documents to prove sufficient capital.

- Specific permits and licenses required for your industry (e.g., health permits for restaurants, educational licenses for training centers).

Make sure all documents are properly attested and translated into Arabic if required. Double-check the validity of your documents and ensure they meet the specific requirements of the relevant government authorities. Investing time in accurate document preparation will save you headaches later on.

Selecting the Appropriate Government Authority for Your Industry Sector

The government authority responsible for granting approvals depends on the nature of your business. For example, the Department of Economic Development (DED) is responsible for licensing most mainland businesses. However, specialized industries, like healthcare, education, and finance, require approvals from specific authorities like the Dubai Health Authority (DHA), the Knowledge and Human Development Authority (KHDA), and the Central Bank of the UAE, respectively.

Identifying the correct authority early on is important. Applying to the wrong entity will inevitably lead to delays and potential rejection. Thoroughly research which authority regulates your industry and understand their specific requirements and procedures. Consulting with a business setup consultant can be beneficial in this regard, as they possess in-depth knowledge of the regulatory landscape.

Navigating the Trade Name Registration Process Effectively

Registering your trade name is one of the first steps in the business setup in UAE process. Your trade name must be unique, compliant with the UAE’s cultural and ethical standards, and not infringe on any existing trademarks. You can submit your trade name application online through the DED’s portal or through authorized service centers.

The DED will check the availability of your proposed name and its compliance with the regulations. If approved, you’ll receive a trade name reservation certificate, which is valid for a limited time. It’s vital to choose a trade name that accurately reflects your business activities and resonates with your target audience. Avoid generic or misleading names that could cause confusion or be rejected. A well-chosen trade name can contribute significantly to your brand identity and recognition.

Acquiring the Necessary Business Licenses and Permits

Once your trade name is registered, you need to obtain the relevant business licenses and permits. The type of license required depends on your business activity. Commercial licenses are needed for trading activities, professional licenses for service-based businesses, industrial licenses for manufacturing, and tourism licenses for travel-related businesses.

The application process usually involves submitting the required documents to the relevant government authority and paying the associated fees. You may also need to undergo inspections of your business premises to ensure compliance with safety and health regulations. Be prepared to provide detailed information about your business operations, including your products or services, target market, and staffing arrangements.

Securing the correct licenses and permits is not merely a formality; it’s a legal requirement. Operating without the necessary approvals can result in hefty fines, business closure, and even legal action. Therefore, meticulously follow the licensing procedures and ensure you comply with all applicable regulations.

Understanding the Visa Application Process for Business Owners and Employees

If you are not a UAE national, you’ll need to obtain a residency visa to live and work in the country. The visa application process typically involves several steps, including medical tests, security checks, and the submission of required documents to the immigration authorities. The process differs slightly depending on whether you are an investor visa applicant or an employee visa applicant.

As a business owner, you can apply for an investor visa, which allows you to reside in the UAE as long as your business is active and compliant. Employees need to be sponsored by their employer to obtain a residency visa. The employer is responsible for handling the visa application process on behalf of their employees. Familiarize yourself with the latest visa regulations and requirements, as they are subject to change. Using a reputable visa processing agency can streamline the process and minimize potential delays.

The Meydan Free Zone offers a streamlined approach to business setup in UAE, including assistance with visa applications and licensing. This can be especially helpful for new entrepreneurs who are unfamiliar with the local regulations. They provide support throughout the entire process, from initial registration to ongoing compliance.